.webp)

This article is part of our Valuation by Business Model series, in which we provide you with information on what makes your particular business model unique when it comes to SaaS business valuation. For more in-depth reading on valuation, see our post How to Value a Website or Internet Business. To get your SaaS business valued for free, please fill in the main form on our Sell a Website page.

Software as a Service (SaaS) is a unique and growing industry, and one that requires special considerations when it comes time to sell. As the market-leading advisor for SaaS business sales, the team at FE International answers questions every day about the best practices of selling a SaaS business and which SaaS metrics should be measured.

In this post, we leverage our experience and insights from hundreds of our SaaS sales to take a deep dive into SaaS valuation and salability, providing the definitive resource for selling a SaaS business.

State of the Market

In 2025, the global SaaS market was valued at $247 billion. By 2030, it’s expected that this number will reach $908.21 billion, with a CAGR of 18.7% during the forecast period of 2024 – 2030.

In a Wall Street Journal essay, investor Marc Andreessen wrote, “Software is eating the world.” That was over a decade ago, but it’s a line that holds true today. SaaS funding is growing at an exponential rate – in the last ten years, SaaS funding has increased by almost seven times and outpaced the growth of overall venture capital funding by almost six times. The increase in investor interest surrounding SaaS is primarily due to its growing use case and expansion into new industries.

The SaaS industry has been on a bull run for quite some time, and according to BetterCloud, every organization will eventually become a SaaS-powered workplace. Although some are still in the early stages of their SaaS adoption journey, it’s only a matter of time before SaaS will power every organization. Net growth of SaaS apps used was up 18% this year, with organizations now using 130 apps on average. Gartner recently predicted that worldwide end-user spending on public cloud services is forecast to grow 21.5% to total $723.4 billion in 2025, up from $595.7 billion in 2024.

At FE, we are seeing a consistent increase in interest for enterprise software and SaaS businesses. The increase comes as companies seek a competitive edge over their competitors. SaaS platforms can provide a company with the strategic upper hand they need to acquire insight from large amounts of data and cloud-based infrastructure that offers flexibility and control. We’re seeing an overall heightened demand for high-quality SaaS businesses, and we expect this to remain high for the rest of the decade.

For more insights into the current state of SaaS, check out our latest report here.

How SaaS Businesses Get Valued

How to value a SaaS business is perhaps one of the hottest and most ambiguous debates among small business entrepreneurs, investors and advisors at the moment. If you want an accurate valuation, you can receive a free one via our page here. If you want to understand how to value a technology business, the first question is whether to look at a multiple of SDE, EBITDA or Revenue.

Stories of wildly high revenue multiples for unicorn SaaS businesses can seem at odds with the modest earnings multiples for smaller SaaS businesses, which serves to confuse the information in the marketplace. The reality is that different SaaS companies can represent entirely different investment propositions.

The main differences come down to the size and growth of the businesses in question, as we explore in depth below.

SDE vs. EBITDA vs. Revenue

There’s always a few different ways to get a job done, but it’s important to know the best way for each type of job.

When determining business valuations, you’ll usually focus on SDE for smaller companies and EBITDA for larger. But for SaaS companies, neither of those may really work. Let’s dig into it:

Using SDE for Valuation

Most small businesses valued at under $5,000,000 are valued using a multiple of seller discretionary earnings (SDE or sometimes also called seller discretionary cash flow) particularly if they are relatively slow growing and do not have a management team in place.

SDE is the profit left to the business owner once all costs of goods sold and critical (i.e. non-discretionary) operating expenses have been deducted from the gross income. Crucially, any owner salary/dividends can be added back to the profit number, too.

More easily it is described as:

SDE is used for small business valuation to demonstrate the true underlying earnings power of the business. Most small businesses are owner-operated and somewhat owner-reliant and therefore have an associated owner salary and expenses. The owner is likely to pay themselves a salary for the work – which may not be correlated with the market rate and pay several personal items through the business for tax efficiency. These are acceptable addbacks to reflect the true earnings power of the business.

Using EBITDA for Valuation

The situation changes though as businesses grow larger. In bigger companies, there are more employees and more management personnel. Similarly, the ownership structure tends to fragment with several shareholders who typically play a less active role in the business, often hiring a general manager or CEO to oversee operations. In this situation, any owner compensation or discretionary expenses should be reflected back into the business to show its true earnings power. A new benchmark of earnings before interest, taxes, depreciation, and amortization (EBITDA) is employed. In acquisitions with companies with over $5,000,000 in value, EBITDA multiples are almost exclusively used throughout the industry.

Using Revenue for Valuation

For most businesses, the valuation benchmark debate stops there. Either SDE or EBITDA is considered the best proxy for the business’s future cash flows and is therefore the basis of its valuation. For SaaS companies, however, the EBITDA being generated today – which could be zero – is not always a good proxy for potential future earnings. This is because growing SaaS businesses make significant upfront (and sunk) investments in growth, which are all expensed in current EBITDA. Owing to their recurring revenue model and assuming customers stay with the business, the profit in the future will expand significantly as the business matures and spends relatively less on these items.

Measuring revenue makes sense for a growing SaaS valuation, buts it is very important to note that this valuation philosophy is entirely based on growth. If the SaaS business does not grow then the revenue is not there to support the forecast profit in the future, which is what the valuation is actually based on.

How to Select SDE, EBITDA, or Revenue for Your Valuation

The test for SDE vs EBITDA vs Revenue is:

- Is the business reliant on the owner?

- Are revenues growing less than 50%+ YoY?

- Does the business generate <$2,000,000 revenue per year?

An answer of “yes” to any or all of the above means the SaaS business is one for a valuation using SDE. Investors will likely appraise the business based on this benchmark alone and apply a multiple to arrive at the final business valuation. If the answer is “no”, EBITDA or revenue might be more appropriate.

This leads to the next question, how to decide the multiple?

Finding the Multiple

The multiple is one of the most important pieces of the equation and is affected by dozens of factors related to the business. Those factors span a wide variety of financial, traffic, and operational aspects, but ultimately it boils down to the sustainability, scalability, and transferability of the business.

Any operational or market factor that directly or indirectly impacts these core drivers will influence the multiple.

FE International uses a proprietary internal valuation model to derive the value of a SaaS business. We’ve discussed this in-depth in our post on how to value an online business. Here’s a sample of the types of questions to consider in SaaS company valuations:

This is a short summary of the questions and factors involved in a full SaaS business valuation. We typically analyze 80-100 areas benchmarked against 40,000 – 50,000 data points before arriving at a firm valuation. We also look at DCF modeling, historic price and revenue regression analysis for completion

SaaS Metrics that Impact Valuation

SaaS businesses typically fall within the 4x – 10x annual profit (SDE) range, and this can be determined by a large number of SaaS metrics.

In the initial assessment, it is useful to filter these variables into a few that have the most influence to determine whether a SaaS business’ multiple falls towards the low or premium end of the valuation spectrum. Metrics to consider include:

- Age of the business: A SaaS business with a longer track record demonstrates that it has proven sustainability and is also easier to predict in terms of future profit. Businesses that are 2 years old are the preferred entry point, and at 3+ years they start to receive more of a premium multiple. Younger businesses are still sellable, albeit to a slightly smaller investor audience that may have a higher risk tolerance.

- Owner involvement: Part of the appeal of running a SaaS business is the potentially passive and predictable nature of the income it brings. Businesses that require relatively little time and have a team in place are more attractive than those that require a lot of owner work. Outsourcing can help here (more on that later). The other dimension to this is the technical involvement of the owner. If an investor must replace an owner that is performing a highly skilled role, this will either increase the replacement cost or put off non-technical investors, which reduces overall demand for the business.

- Growth trends: Few investors aspire to acquire a SaaS business that is declining, and correspondingly few owners want to sell a SaaS business that is growing rapidly. The key is to sell a business that is trending consistently and, ideally, modestly upward. Naturally, the faster the business is sustainably growing, the more the multiple will stretch toward the premium end.

- Churn: It is well documented that customer metrics are of vital importance for SaaS business owners and consequently they are of great interest to investors. Churn, lifetime value (LTV) and customer acquisition cost (CAC) are analyzed by investors when appraising the customer base and, by virtue, the quality of the business’ revenue.

- Funding status: A company’s funding status affects its valuation. Pre-revenue and early-stage companies don’t typically go through a valuation process. Their valuation depends upon the owners’ fundraising goals. For example, if the owner wants to raise $4 million and only wants to give up 10 percent of the company, the owner will value the company at $40 million. As the company moves into B series funding rounds, valuation focuses more on revenue growth. Valuation of pre-IPO companies tends to consider customer retention and gross margin as primary factors. Public SaaS companies tend to receive higher multiples than companies funded by private equity, all other factors being equal. The multiple for private firms is generally discounted by a percentage that can scale with changes to public markets.

Valuation Spectrum

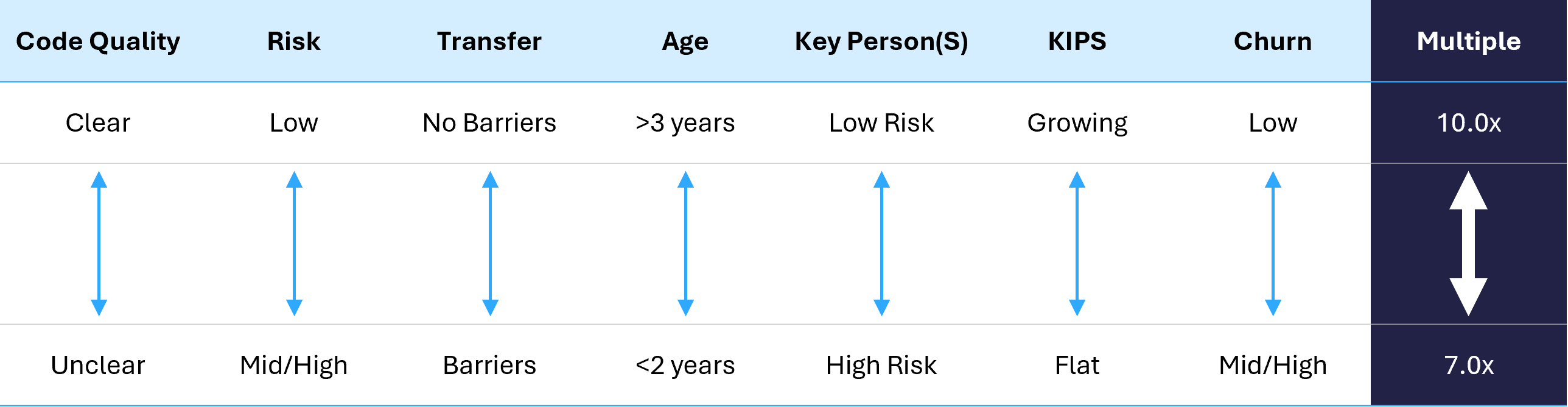

The following diagrams should give you a good feel of where a business could be valued. For businesses valued under $2 million, you can expect a 5.0x to 7.0x multiple.

For businesses valued over $2 million, you can expect a 7.0x to 10.0x multiple.

While the general valuation drivers above are a key consideration, it’s important to note that every SaaS business is unique and each has its own priorities in terms of metrics.

As the valuation process goes deeper, more business model-specific factors come into play when determining the final multiple. One example is the rule of 40, which says that a healthy SaaS company has a combined revenue growth rate and profit margin of 40 percent or more. For example, if the company is growing at a rate of 30 percent year over year and has a profit margin of 10 percent, it would meet the rule of 40 requirements. A company’s business model also determines the right profit metric to use in the calculation; for example, operating income vs. EBITDA.

The rule of 40 is not appropriate for all companies, however. If new companies focus on the rule of 40 too early they may limit their growth. Their valuations then will be lower because they’ve failed to deliver high growth.

Another example of how the business model influences SaaS valuation multiples is the amount of owner time and influence the business model requires. Generally, revenue multiples are lower for those businesses where the owner is central to the business’s operation.

Which SaaS Metrics Matter Most?

Investors looking to buy a SaaS business are looking for points of strength and differentiation. To determine the points of strength and differentiation, investors will often look at a few key metrics.

Let’s explore the most commonly evaluated metrics in SaaS valuation.

Churn

Churn is a significant driver of valuation because it touches upon all the key factors that impact the perceived future cash flows of a SaaS business. The importance of this metric should not be underestimated when you consider the long-term impact on the business. Taking the following example of two companies with 5% and 20% annual churn, the corresponding revenue after 10 years is markedly different.

Provided there is a consistent flow of new customers at an acceptable cost of acquisition rate, low churn will allow recurring revenues to grow, improving the growth rate and reducing the risk of value loss over the long term. A high churn rate has all the inverse effects and can also say to investors that the product does not adequately fit the customer’s needs, sits in a market with limited demand or there are stronger competing products. This would imply that the product requires further development at their expense.

How Much Churn?

The importance of churn is widely accepted. However, it is less easy to find consensus on the acceptable rate of monthly revenue churn for SaaS businesses.

Here the line again blurs between smaller, SDE-valued SaaS businesses and the larger EBITDA revenue-valued VC-funded SaaS businesses. Bessemer Venture Partners, an investor in VC-funded SaaS businesses, says an acceptable churn rate for these is in the 5 – 7% range annually (0.42 – 0.58% monthly). Key Banc’s Private SaaS Company Survey that shows roughly 80% of surveyed large SaaS companies had annual median gross churn of 14%.

Contrast this with Churnkey’s How Churn Affects SaaS Company Valuations, which states for a smaller SDE valued company with an average MRR of $10,500 found a healthy average monthly churn rate was 3.2% (annualized that is 32%). Similarly, Open Startups sampled 12 companies with an average $18,900 MRR and found a median monthly customer churn rate of 5.4% (46% annually) and monthly revenue churn of 11.2% (75% annually).

So why the substantial difference? It comes down in large part to which customer segment the business is targeting.

To begin with, most SaaS businesses focus on servicing the needs of small to mid-sized businesses. Small businesses have lower demands and less sophisticated needs, so this is an easier point of entry than enterprise-grade software.

The challenge though is that smaller customers tend to have higher churn rates. Generally speaking, SMB customers tend to alternate SaaS products more regularly because switching costs are low and are more likely to go out of business.

Tomasz Tunguz from VC firm Redpoint sums it up well:

“In practice, churn rates vary by customer segment. Startups serving SMBs tend to operate with higher monthly churn, somewhere between 2.5% and 5%+, because SMBs go out of business with greater frequency and tend to be acquired and managed through less retentive channels, e.g. self-service. In the mid-market, which I’d define by average customer revenue of between $10k and $250k loosely speaking, the churn rates I’ve seen are between 1% and 2% per month. Enterprise companies, those with customers paying more than $250k per year are typically closer to 1%. As the spend per customer grows, startups can afford to invest significantly more in retaining the customer, hence the improving rates.”

This latter point is also vital to the difference in churn between cash-rich and cash-poor SaaS businesses. The cash on hand that enterprise-level and VC-backed SaaS companies have to spend on sales and client retention personnel versus what is available to smaller, owner-operated SME-facing SaaS businesses is not comparable at all.

So where to end up?

Monthly Churn Average Annualized

We took data from a sample of the last 25 SaaS business acquisitions at FE International ranging from $250,000 to $20,000,000 in value across a variety of niches in both B2B and B2C SaaS.

We found a monthly customer churn range of 1.0% to 11.0%, with an average of 4.7% (annualized 43.9%). The higher churn businesses tended to be those in very competitive niches and those aimed at shorter-term or seasonal usage (e.g. recruitment).

Our findings map similarly to Tunguz’s observations of customer churn, which he thinks to be 3-7% for SME-focused SaaS while lower for mid-market and enterprise-grade:

Higher churn is almost a fact of life for smaller SaaS businesses. The focus for investors should in part be on improving the churn rate where possible but more fully placed on customer acquisition to replace those churned customers.

Customer Acquisition Cost (CAC)

The Customer Acquisition Cost (CAC) is the total marketing and sales cost to acquire one additional customer. Obviously, the lower this number is the better, as that would mean you are spending less to acquire customers. However, there is no magic number when it comes to CAC because each SaaS business is going to be different. To make an apples-to-apples comparison we first need to incorporate an additional metric – Customer Lifetime Value (LTV).

Customer Lifetime Value

LTV is the average amount of revenue that is earned from a customer throughout the time they are paying for the service. The higher the LTV is the more valuable each new customer is to the business. Just like CAC, there is no standard LTV number. Once again, the number will vary depending on the business model, market, competition, and a multitude of other factors.

The LTV/CAC Ratio

To truly get the most use out of these two metrics we must compare them to each other. In doing so, we will get a ratio that will quickly tell if a business is making more revenue per customer than it is spending to acquire that customer. This allows us to measure the return on investment of marketing efforts and determine if the growth strategy is working.

The general rule of thumb is that an LTV/CAC ratio of 3 is ideal for most SaaS businesses. This will allow for enough cushion to account for a dip in the LTV or an increase in the CAC and still be able to generate a healthy gross profit margin.

MRR vs ARR

In small- and mid-market, self-funded SaaS businesses, the temptation is to sell reduced-priced annual plans to increase top-line revenue and improve cash flow to reinvest into growth. While in many situations this is necessary, from a valuation perspective it will hold the business back. The same goes for selling lifetime plans – these are a big no-no when it comes to increasing the value of a SaaS business.

SaaS metrics of revenue, in order of value to an investor:

This is often the opposite of what an owner of a SaaS business will look to do, especially when looking for growth capital. Even if it slows growth, focusing on selling monthly plans is key to achieving higher valuations. Data from deals completed by FE indicate that monthly recurring revenue (MRR) is valued around two times higher than equivalent revenue from lifetime plans, so this can often outweigh the benefits of the short-term cash flow boost.

The average SaaS business sold by FE over the past decade had a 5:1 ratio of MRR to ARR (annual recurring revenue) – this is an ideal mix to aim for to maximize valuation. Generally, these products will have annual plans priced 10-20% less than monthly plans and years of ARR churn data. SaaS products with a higher ratio of annual plans would see a lower valuation as the revenues are less predictable.

Other Factors to Consider When Valuing a SaaS Business

Aside from the SaaS metrics just touched on, there are various other important factors that need to be considered in the valuation process. We took data from the last 25 SaaS businesses sold at FE, ranging from $250,000 to $20,000,000, and pulled out some of the common threads of premium SaaS valuations.

Customer Acquisition Channels

Acknowledging the higher rate of churn that small- and mid-market, SME-facing, SaaS businesses experience, customer acquisition is understandably a focal point for evaluating the longevity of these businesses. If the business is losing 30-50% of its customers per year, the only option is to add a significant number of new customers each month to counteract the loss (at least in the short-to-medium term).

The customer acquisition channels of a SaaS business are thus of great importance to investors, who tend to evaluate these in terms of concentration, competition, and conversion. Investors will also consider your total addressable market (TAM) to determine the company’s upside potential.

Concentration

In our experience, a premium SaaS business will acquire customers from a multitude of channels, be it organic search, affiliate, paid or otherwise. Having a diversity of channels not only reduces the dependency on one channel but also proves its monetization in multiple ways. SaaS businesses that have successful organic and paid channels benefit from this premium with investors.

Naturally, many small- and mid-market SaaS businesses build their customer acquisition from content marketing before exploring paid and affiliate channels. It can be a worthwhile experiment to trial the 3-6 months ahead of an exit to see whether they yield positive ROI. Not only will this improve the value of the business’ earnings (and thus the SDE for valuation) but it will demonstrate to investors that the business can be monetized in multiple channels.

Channel Competition

The defensiveness of each acquisition channel is of interest to investors when evaluating their strengths. If the business has a strong backlink profile and ranks well for a high number of relevant keywords this is considered a strong, defendable platform for organic customer acquisition.

Conversely, if the business is engaged in price wars in paid searches with competitors, this is understandably considered a weaker acquisition channel. Search “project management software,” for example, to see ads for several different well-funded companies competing for the term. Small- and mid-market SaaS business trying to outbid in that niche will suffer a short-lived PPC lifecycle.

Conversion

The ultimate appraisal of customer acquisition channels is the associated conversion and cost attached to each. Here the conversion-to-trial ratio and conversion-to-paid ratio are carefully eyed by investors, as well as the associated CAC.

To summarize, a premium SaaS business is one that has multiple customer acquisition channels with high defensiveness and solid conversion metrics for each.

Product Lifecycle

Eventually, all software needs development to keep up with customer requirements or to grow the business further. A product’s development roadmap can be dictated by a number of factors, including customers, competition or even the owner’s ambition.

While every SaaS business is unique in its development requirements, when the business comes to market, it is generally best practice to have the product in a high point of its development life-cycle, or in other words, not requiring a major update any time soon. This gives the new owner some runway ahead of any major development and provides some comfort that the current management has not simply given up on the business and is passing over ownership at a time when the product needs care and attention.

In the diagram above, it is the equivalent of selling at point A, where the software is maturing, and point B where the software has aged too much and is in need of development to promote further sales. In the diagram above, it is the equivalent of selling at point A, where the software is maturing, and point B where the software has aged too much and is in need of development to promote further sales.

Technical Knowledge

As mentioned briefly, the amount of owner involvement in the business and particularly the nature of the work can be a sensitive valuation factor for SaaS businesses. At first this might seem counter-intuitive to a SaaS entrepreneur. More technical input from the owner (i.e. development) suggests a sophisticated product, which implies unique IP and a high-quality product.

All of the above could be true, but an investor still needs to either be able to do the same work themselves or pay for someone else (usually at a high cost). Factoring this into the SDE will ultimately lower the valuation.

One might be tempted to instead pursue investors that can readily resume the same responsibilities themselves (i.e. purely seasoned SaaS business owners) but this can reduce the pool of available investors significantly.

To put it into context, of the last 25 SaaS acquisitions at FE International, 64% were acquired by investors that would describe themselves as non-technical. This is especially true as valuations surpass $1,000,000. SaaS businesses that therefore have the burden of development work on reliably outsourced contractors will benefit from a perceived easier transfer of ownership and a greater pool of investors as a result.

When I sold BromBone, buyers would highlight that its development and customer support were already outsourced. The only role they needed to replace was my marketing outreach, which meant it was an easier business to take on. Eventually we sold to a non-technical buyer for a great valuation. –

Chad DeShon, Founder of BromBone

Competition

Competition in the niche is of great interest to investors when evaluating a SaaS business. Clearly, the level of competition is important to understand for any business acquisition, but this is especially true in the SaaS space.

In SaaS, it becomes of acute interest because of the generally higher number of VC-funded players in the industry and the high development costs associated with the business model. Small- and mid-market SaaS businesses in a highly competitive niche will tend to find themselves underfunded and unable to compete with the development efforts and features of better-funded, VC-backed SaaS companies.

The SaaS businesses that achieve a premium are almost always products that are prepared for growth at scale.

What Can You Do to Increase the Value of Your SaaS Business Before a Sale?

An exit strategy for any business is crucial before a sale.

You can add hundreds of thousands of dollars of value to a business by taking the right steps before a sale.

Naturally not all the valuation factors are addressable (e.g. competition in the niche) but there are a number of strategic moves you can make to increase the value of your SaaS business before a sale.

Below we discuss six key topics to think about in the run-up to the sale.

Reduce Churn

With churn such an important aspect of SaaS valuation, it’s a key element to try to reduce ahead of coming to market. There are many ways to reduce churn and a full exploration of these is well beyond the scope of this article, but below we’ve highlighted some of the best writing on the topic:

3 Things We Did to Reduce Churn By 68% by Josh Pigford at Baremetrics

Pigford discusses a suite of tactics that helped reduce churn at Baremetrics, including, controversially, blocking the ability for users to self-cancel. A highly interesting read.

9 Case Studies That’ll Help You Reduce SaaS Churn Metrics by Casey Armstrong for CXL

Armstrong utilizes case studies to help understand how critical it is to reduce churn for the success of your SaaS company.

How to Reduce SaaS Churn with Fast Customer Onboarding by Dennis Hammer of Audience Ops

When it comes to growing your SaaS business, sales aren’t enough. You have to retain your customers as well Hammer explains. Each time you lose a subscriber, you have to gain a new one to fight the churn. This slows your growth substantially, especially since we know that it costs five to 25 times more to acquire a new customer than retain an old one.

Outsource Development and Support

As touched upon in the valuation drivers above, there is both a ‘passivity premium’ and a non-technical premium that can be attached to SaaS businesses that have effectively and reliably outsourced development and customer support.

Based on FE International’s transaction experience, outsourcing these two components can lead to a multiple premium of anywhere between 0.5x – 0.75x. It can also reduce the buyer’s assumed owner replacement cost which lifts the business’ earnings for multiplication and thus the valuation even higher. This double-win means that effective outsourcing is one of the greatest levers of exit value for SaaS business owners. [Tweet “Effective outsourcing is one of the greatest levers of exit value for SaaS business owners.”]

The focus here should be on effective and proven outsourcing. A haphazard attempt to move customer support to an unproven call center in the Philippines will not be regarded favorably. We will cover some best practices for outsourcing later on in this article.

Secure Intellectual Property (IP)

It might seem obvious, but a surprising number of business owners fail to properly secure their intellectual property ahead of a sale, which can have detrimental effects on the transaction later on.

Securing IP is very important for SaaS businesses, particularly for transactions of >$500K where the cash check being written starts to become significant. Ideally, this should have been pursued in the early stages of the business’ development but there is no harm in retroactively applying for a trademark ahead of a business sale. You can do this through the United States Patent and Trademark Office. Trademarks tend to be easier, shorter, and less expensive to apply for than patents.

Securing IP doesn’t just stop at trademark filing. Any individual that was involved in writing code or developing the product should be asked to sign an IP assignment for their work. This is particularly relevant to contractors hired from freelancer marketplaces as well as any other third-party company used. This is a standard due diligence request for larger ($500K+) larger SaaS sales but is worth securing right from the outset on any sized business.

Document the Source Code

A well-documented, annotated, and tested source code is a distinguishing factor of premium-valued SaaS businesses. Particularly on the upper end ($500K+), well-documented code is almost a must-have for investors that are looking to scale the business into 7-figures and beyond. It can be a deal-killing issue and is one that is readily avoidable through adequate preparation ahead of coming to market.

Most developers are very competent at code documentation, but it never hurts to brush up on best practices for commenting code and how to write a good documentation code that developers should always follow.

Position the Product

As we looked at above in the product lifecycle analysis, where the product is at in its development cycle when it comes to market is important to investors and influential on the exit multiple. Business owners plotting a sale should think about planning their next major upgrade 3-6 months ahead of going to market.

This has a number of short and medium-term benefits. First, it brings some immediate additional earnings to the current owner, assuming a positive uptake and increase in trials for new customers. Second, it lifts the earnings figure (the SDE) which forms the basis of the sale valuation. Third, assuming a positive take-up, it will create positive customer feedback and potentially PR as well. Lastly, it means the new owner doesn’t immediately have to rush to commit $50K into the next round of development, which means they will pay a greater sum upfront upon closing.

Avoid Discounting

Tempting as it can be for some business owners, launching an unprecedented sale of annual plans to book a large amount of revenue ahead of a sale is not a wise strategy. Sellers have been known to do this to inflate the valuation ahead of a sale and to generate additional cash. Unfortunately, all buyers see through this strategy and either discount the relevant months or steer clear of the sale entirely. Unserved portions of packages sold on annual plans are often rebated to a new owner, so this is a pointless exercise.

The key to a successful exit is to continue to run the business in a similar fashion in the months before and during the sale. If a sale is seasonal (e.g. Black Friday), that is an acceptable event to run a discount. If it’s outside of normal proceedings, it’s best to avoid discounting altogether.

Salability: How Attractive is Your SaaS Business?

Ahead of going to market, you’ll need to look at the salability of your SaaS business, or rather, how attractive it looks to buyers and how attractive it is to own. This is broader than just the fundamentals discussed thus far, it comes down in large part to the operational setup.

Here are some tips to help you improve operations efficiently and effectively:

Documentation

You’ll need to have detailed financials for your business in order to prepare for a sale. Accounting applications, such as QuickBooks, can be a big help, but make sure your accounting is up to date – and keep it that way as you enter the sale process.

Details are key, and so is organization. Serious buyers are unlikely to sift through months of financial records and tax returns to determine whether the investment is worth it. Luckily, a good broker can assist you in this process.

You should also be prepared to give prospective buyers any analytics you have for past and current ad campaigns, email data, and website traffic.

Operating Procedures

Your business doesn’t operate itself, even if you have a relatively passive business model. Prospective buyers will need to know the responsibilities involved in your operation, so document all of your daily, weekly, and monthly processes and procedures. This will make the transition faster and easier for both of you.

Moreover, buyers may be more inclined to pay a premium for businesses with well-documented operations, so this step could easily translate to a higher profit for you. There are some useful software applications for writing standard operating procedures (SOPs) quickly like SweetProcess and some useful guidance online about writing best in class documentation.

Removing myself from the business and getting it to a point where it could run on “autopilot” was a goal from the start. So I focused a lot on writing detailed procedures, and refining those over time with the help of my talented team. We also used software—both our own and other software tools—to streamline much of the processes in the service. –

Brian Casel, Founder of Restaurant Engine

Customer Metrics

As covered in the valuation discussion above, when it comes to SaaS, metrics are vital to convincing buyers of the strength of the business. Seasoned investors in the space will review MRR, churn, LTV, CAC, retention and your cash burn rate closely. Not sure what those first three are? We put together a handy cheat sheet to help you understand:

The good news is you don’t need to calculate these yourself. The SaaS analytics industry has a number of great solutions for business owners including Baremetrics (for Stripe), ChartMogul (for Stripe, BrainTree, Recurly and PayPal) and FirstOfficer (for Stripe) to name a few. Make sure to integrate these with your merchant processor well in advance of a sale, to capture the relevant historical data before going to market. Note: ChartMogul has a useful tool for loading past data too!

Outsourcing

The prospective buyer for your business is not necessarily looking for a job, so if you’re able to reliably outsource tasks to agencies, contractors or virtual assistants, do it. Online businesses that are more passive in nature tend to sell at a higher price than those that involve more work on the owner’s part.

Remember the ‘power of passivity’: it’s a potentially huge value driver for the sale of your business. Owners who can successfully remove themselves from the day-to-day of their business often find that they benefit from a higher valuation once they’re ready to sell.

Virtual assistants can be very useful in this regard and we’ve discussed effective hiring and delegation here.

Powder in the Keg

If you’ve done the legwork developing a new feature and creating a marketing strategy around it, it can be worthwhile holding off on releasing before a sale.

The addition of a brand new product or revenues will need 3-6 months of history to move a valuation higher (this is not unique to SaaS businesses). A smarter strategy is often to use this as leverage to gain stronger offers off the existing valuation and get a higher cash consideration upfront. This can often offset the perceived lost profit from delaying the release of the new product or upgrade.

How Can I Get My SaaS Business Valued?

Now you know all about valuation, exit strategy and sale options for your SaaS business, the best way to get a good sense of how much your business is worth is to speak with a broker. They will be able to calculate your profit (SDE) accurately and advise on the applicable multiple based on their assessment of the business and previous transactions.

A good broker will give you the best advice on exit strategy and timing, irrespective of whether this is in their short-term interest. The best advice might not be to sell right now, but instead to do three things to lift the valuation and come back in 3-6 months with a more valuable business for sale. That’s a win for everybody.

Are you interested in selling your SaaS business? Fill out this short form and get a confidential valuation.